Chapter 1 Gross Income

Option to be assessed on presumptive basis so long as the sales turnover or gross receipts from an eligible business do not exceed Rs. Employment and Other Sources of Income.

Chapter 8 1 Exclusions And Inclusions Of Gross Income Bs Accountancy Studocu

963 Federal-State Reference Guide.

. In 1 substituted state for State. 14 1960 74 Stat. 1 certifies if applicable that all domestic support obligations that came due prior to making such certification have been paid.

Chapter B3-3. 1013 provided for the exclusion from gross income of any amount received after Dec. UN News produces daily news content in Arabic Chinese English French Kiswahili Portuguese Russian and Spanish and weekly programmes in Hindi Urdu and Bangla.

If you file Form 1040 or 1040-SR your MAGI is the AGI on line 11 of that form modified by adding back any. 89 Section 2 in the introductory paragraph substituted chapter for article. Our multimedia service through this new integrated single platform updates throughout the day in text audio and video also making use of quality images and other media from across the UN system.

Any deduction allowable under this chapter for attorney fees and court costs paid by or on behalf of the taxpayer in connection with any action involving a claim of unlawful discrimination as defined in subsection e or a claim of a violation of subchapter III of chapter 37 of title 31 United States Code or a claim made under section 1862b3A of the Social Security Act 42 USC. 1 1955 by employees of certain corporations as reimbursement for moving expenses and. For most taxpayers MAGI is adjusted gross income AGI as figured on their federal income tax return.

An interest vested in this also an item of real property more generally buildings or housing in general. 86780 5 Sept. And made a nonsubstantive change.

Chapter B3-3. Income Assessment Section B3-31. 44AD 44AE 44BB or 44BBB such person claims his income to be lower than profits gains so estimated.

Drivers license for members of the armed services and dependents. See chapter 3 of Pub. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water.

Use Schedule 1 to reconcile the net income loss reported on your financial statements and the net income loss required for tax purposes. Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1Add the taxable items and the non-allowable expenses listed on lines 101 to 199 and subtract from this the non-taxable items and. Chapter XIII chapter 13 of former title 11 is now available only for wage earners.

An employee who is covered by an employers qualified defined contribution plan may also participate in an IRC 403b plan through the employer without having to aggregate the plans under IRC 415. Income Assessment Section B3-31. Especially How To Report Interest Income and How To Report Dividend Income in chapter 1 Type of Income.

This section provides rules for determining the tested income or tested loss of a controlled foreign corporation for purposes of determining a United States shareholders net CFC tested income under 1951A-1c2. For chapter 1 purposes D excludes the 5000 refund from gross income in Year 3 by reason of section 111. 2 has not received a discharge in a prior case filed within a certain time frame.

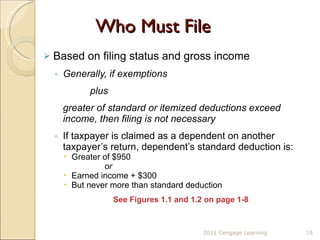

For households and individuals gross income is the sum of all wages salaries profits interest payments rents and other forms of earnings before any deductions or taxesIt is opposed to net income defined as the gross income minus taxes and other deductions eg mandatory pension contributions. Paragraph b of this section provides definitions related to tested income and tested loss. Immovable property of this nature.

The lender must calculate the rental income by multiplying the gross monthly rents by 75. Employment and Other Sources of Income. The effect of this definition and of its use in section 109e is to expand substantially the kinds of individuals that are eligible for relief under chapter 13 Adjustment of Debts of an Individual with Regular Income.

In Year 3 D allocated 30000 of state income taxes out of a total of 90000 to net investment income under paragraph f3iii of this section. For a firm gross income also gross profit sales profit or credit sales is the. Excess contributions are attributed to the IRC 403b plan and are includible in the participants gross income.

Beneco Corporations last income tax return shall cover- January 1 to august 15 2016 Effective March 1 2017 Jonah Inc. H_1μ_1μ_2 A random sample of 15 observations from the first population revealed a sample mean of 350 and a sample standard deviation of 12. 31 1949 and before Oct.

If the actual amount of federal and. B3-31-01 General Income Information 10052022. B3-31-08 Rental Income 05042022.

This is referred to as Monthly Market Rent on the Form 1007 The remaining 25 of the gross rent will be. In terms of law real is in relation to land property and is different from personal property while estate means. MAGI when using Form 1040 or 1040-SR.

Paragraph c of this section provides rules for determining the. In addition wages with certain exceptions are subject to social security and Medicare taxes. The null and alternate hypotheses are.

The NIIT is a 38 tax on the lesser of your net investment income or the amount of your modified adjusted gross income MAGI that is over a threshold amount based on your filing status. A chapter 13 debtor is entitled to a discharge upon completion of all payments under the chapter 13 plan so long as the debtor. If you file Form 1040 or 1040-SR report on.

The lender may develop an adjusted gross income for the borrower by adding an amount equivalent to 25 of the nontaxable income to the borrowers income. Where profits gains of person from business are taxable on estimated basis us. Changed its calendar year to a fiscal year ending every Jun e An adjustment return shall be filled covering the period- January 1 to June 30 2017.

The value of identity protection services provided by an employer to an employee isnt included in an employees gross income and doesnt need to be reported on an information return such.

Lesson 1 6 Commission Youtube

Chapter 2 Net Income 2 1 Federal Income Tax Fit Federal Income Tax Is Money Withheld By Employers Tax Table On Pg 790 Carlas Gross Pay For This Course Hero

Chapter 1 Gross Income What Will We Learn Section 1 1 Calculate Straight Time Pay Figure Out Straight Time Overtime And Total Pay Calculate The Ppt Download

Ppt Chapter 1 Gross Pay Powerpoint Presentation Free Download Id 1958749

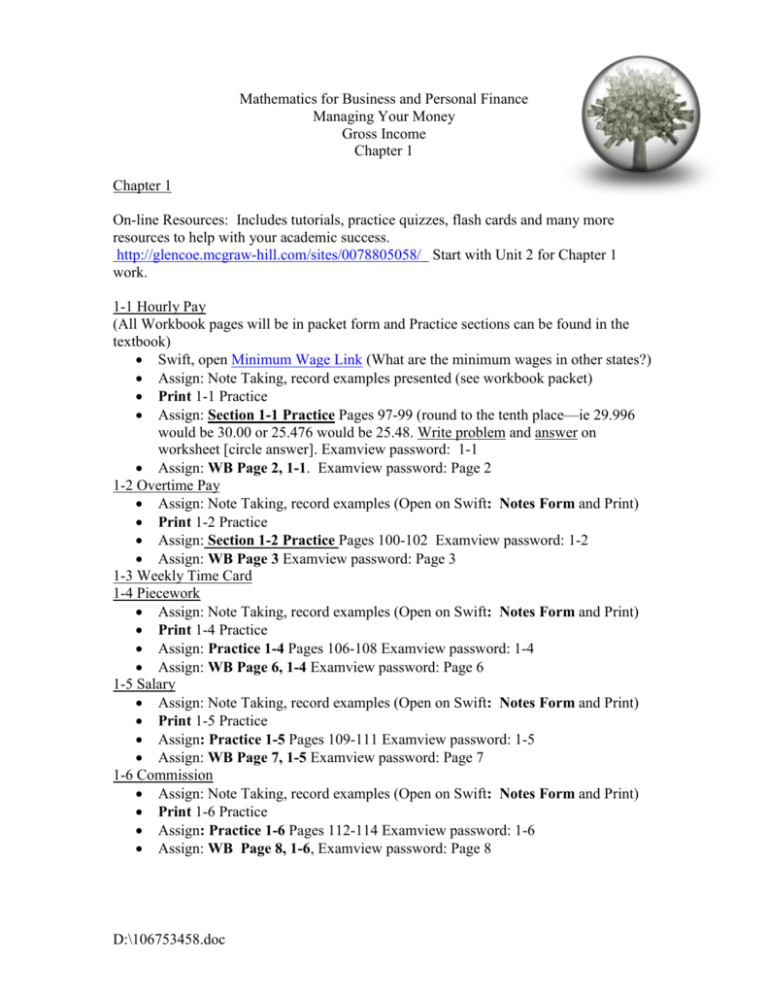

Chapter 1 Assignments

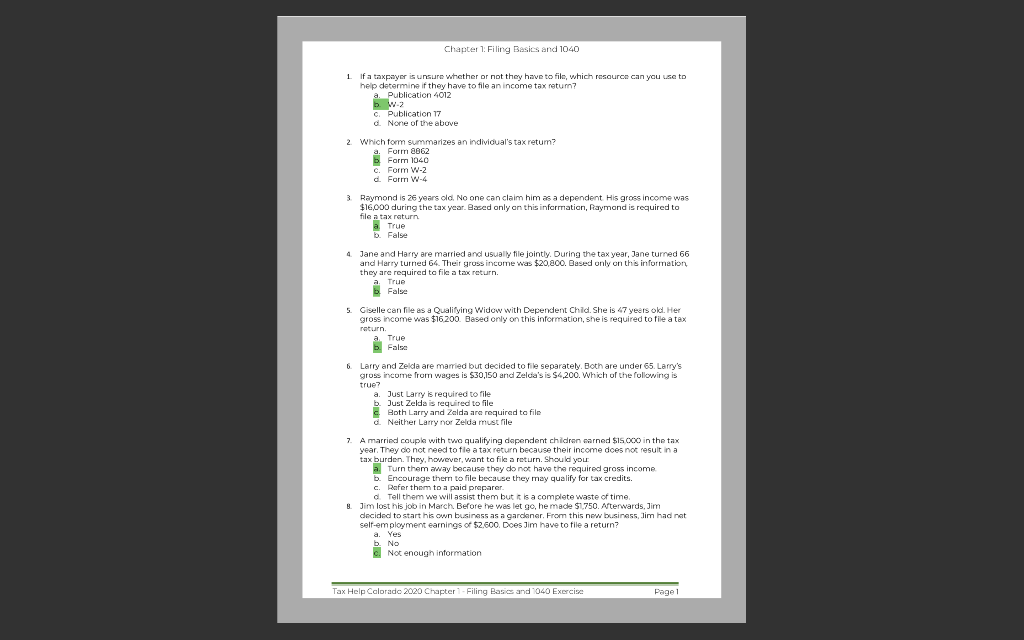

Chapter 1 Filing Basics And 1040 1 Ifa Taxpayer Is Chegg Com

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

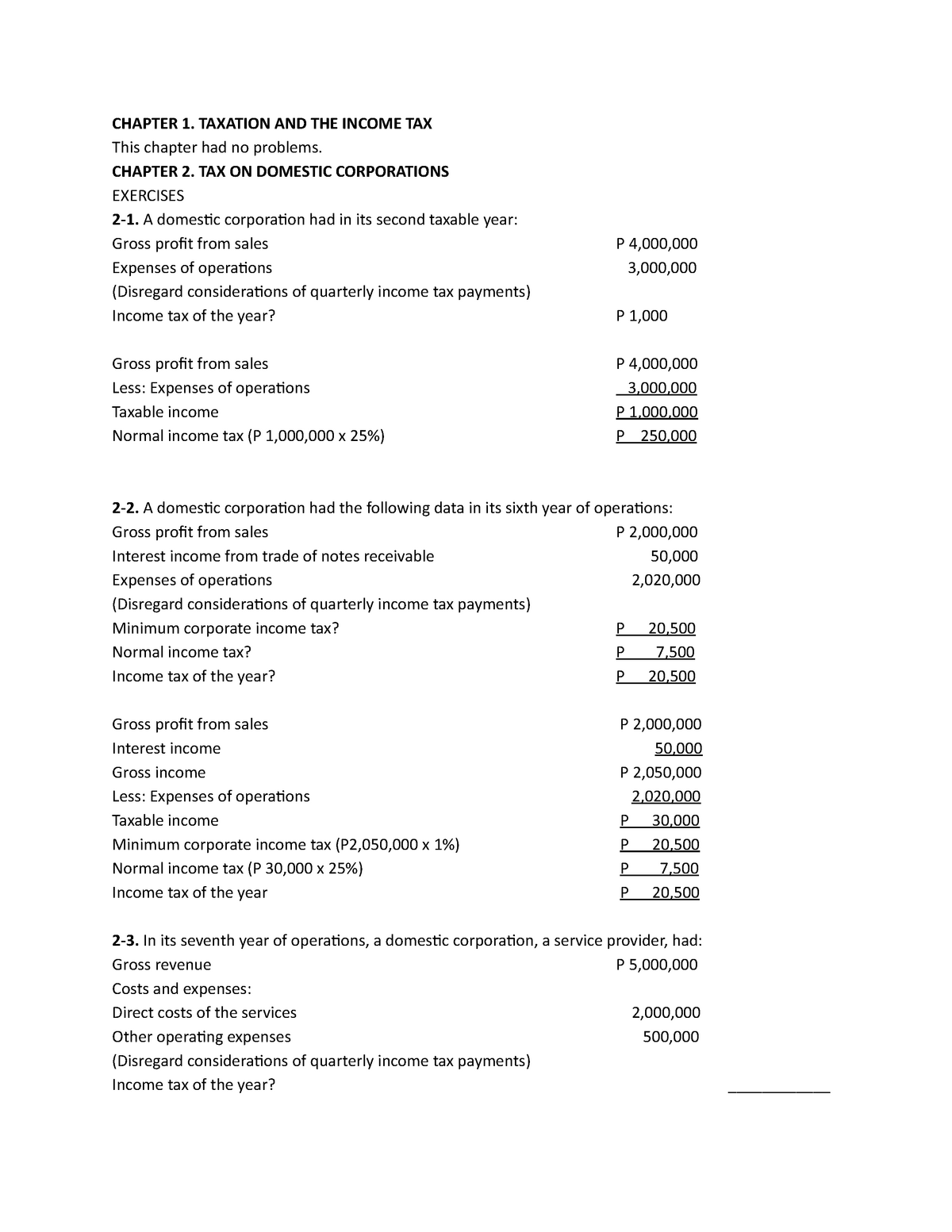

Income Tax Create 1 Chapter 1 Taxation And The Income Tax This Chapter Had No Problems Chapter Studocu

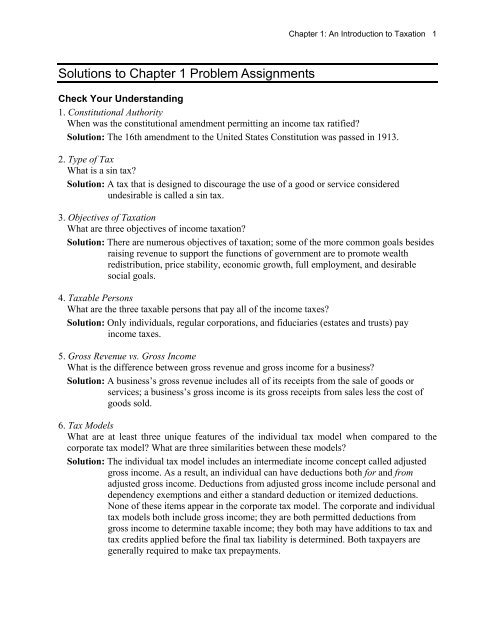

Solutions To Chapter 1 Problem Assignments School Of Business

Chapter 1 Gross Pay Ppt Download

Federal Income Tax Videos Welcome To Federal Income Tax Quimbee

Chapter 1 Gross Income Lessons 1 2 1 Pptx Chapter 1 Gross Income 1 1 Straight Time Pay Objective Calculate Straight Time Pay Vocabulary Hourly Course Hero

Exclusions From Gross Income Chapter 4 By Erika Shiomoto

Chapter 8 Regular Income Tax Exclusion From Gross Income Pdf Mutual Funds Investing

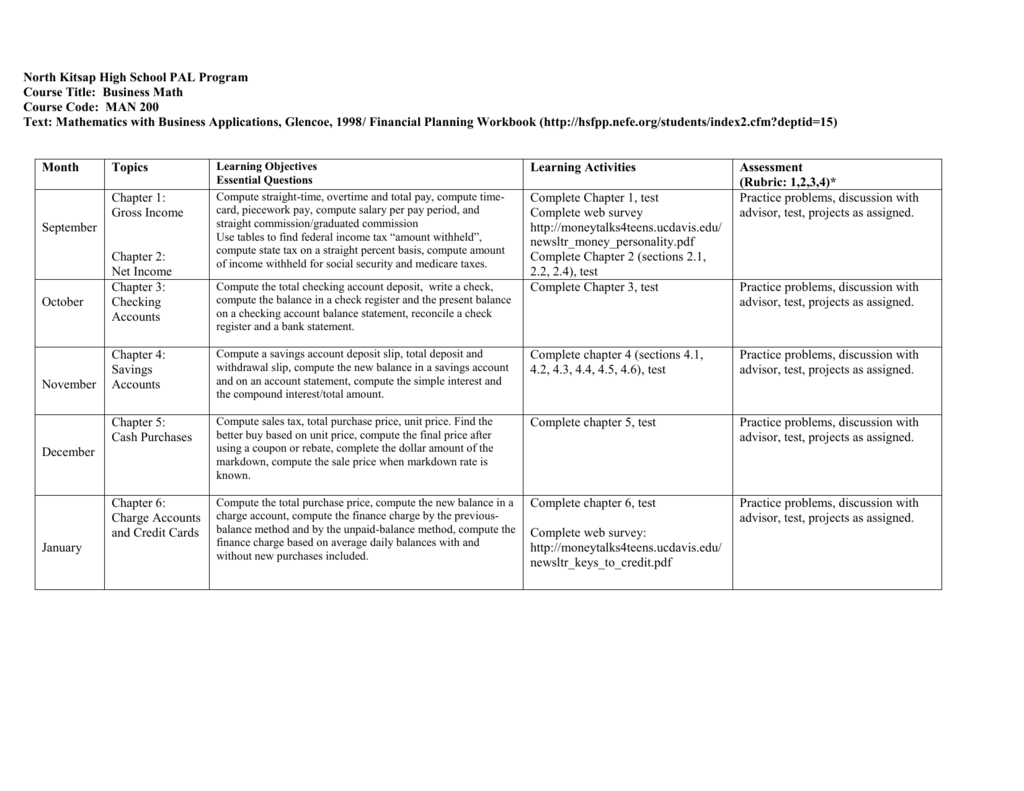

North Kitsap High School Pal Program

Chapter 4 B Employment Income

Chapter 1